Bankocracy

In Fiat Money We Trust

A bankocracy is a system of excessive influence of banks on public policy-making or a form of government. We live in financial times in which extreme inequality keeps growing. We live in an extremely materialistic world in which money is power. Nicholas Shaxson said that to a large degree economies now serve finance instead of the other way round. In 2011 New Scientist reported: An analysis of the relationships between 43,000 transnational corporations has identified a relatively small group of companies, mainly banks, with disproportionate power over the global economy* based on a study that said that transnational corporations form a giant bow-tie structure and that a large portion of control flows to a small tightly-knit core of financial institutions.

The powers of financial capitalism had another far reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. ... The Anglo-American banking elite were able to secretly establish and maintain their global power.

Fiat money

Fiat money is government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government.*

Practically all the money in the world today has no intrinsic value, it derives its value from trust in the government and in the system. Changes in public confidence in a government issuing fiat money may be enough to make the fiat currency worthless. Commodity money, however, retains value based on the metal or other material content it has. Fiat money is therefore more at risk of inflation because its value is not intrinsic.* Fiat money even runs the risk of losing its value overnight in case of a severe crisis or loss of trust.

Money from nothing

source

If you want to understand money, you have got to start with its history, and that means gold. ... The goldsmith starts with safekeeping, then begins making loans, then finds himself the custodian of the community’s money supply because his receipts begin to circulate as money. That puts him in the position of wanting to issue enough of the receipts that he makes full profit off of his lending activities, but not so much that he makes people afraid that he cannot actually back his receipts with gold. This is the basic idea behind the modern banking system.

Besides most money having no intrinsic value, by far most of that money doesn't even exist in physical form. See fractional-reserve banking.

Say a bank has $1,000,000 in deposits. Each night, it must hold $100,000 in reserve. That allows it to lend out $900,000. That increases the amount of money in the economy. The loans help businesses expand, families buy homes, and students attend school. Having $100,000 on hand makes sure it has enough to meet withdrawals. Without the reserve requirement, the bank might be tempted to lend all the money out.*

For example money loaned by commercial banks for a mortgage is merely a number on a computer screen, it doesn't really exist. When the bank enters the number it comes into existence digitally and is created from nothing.

In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.**

The modern banking system manufactures money out of nothing; and the process is, perhaps, the most, astounding piece of sleight of hand that was ever invented.

Fractional-reserve banking is in reality a form of usury. It's criminal.

Debt

screenshot

The flip-side to this creation of money is that with every new loan comes a new debt. This is the source of our mountain of personal debt: not borrowing from someone else's life savings, but money that was created out of nothing by banks. ... By creating money in this way, banks have increased the amount of money in the economy by an average of 11.5% a year over the last 40 years. This has pushed up the prices of houses and priced out an entire generation.**

The financial elite in control of banks create intrinsically worthless money from nothing and loan it to governments and people. All this money will have to be repaid with interest while the value or purchasing power of the money goes down* as a consequence of the growing money supply. Every loan made by these banks is also a debt for nations whose citizens are forced to repay it in future with interest. We live in a world of growing debt. Ben Bernanke, frontman of the Federal Reserve, said...

The U.S. government has a technology, called a printing press, that allows it to produce as many U.S. dollars as it wishes at essentially no cost.*

At essentially no cost? Indeed, the banks who create the money from thin air have essentially no costs, but the taxpayers of the governments who borrow the money will have to repay it with interest.

When money starts as debt, paying the interest in addition to the principal requires more money to be earned as income than has been created. That makes it necessary for the supply of money and the accompanying indebtedness in society to keep growing which has damaging systemic effects for both the environment and society. For example, the economic growth that supports an increasing money supply requires more of the Earth's resources to be turned into commodities. ... Growing indebtedness works in favor of those who lend money into existence and against those who borrow and pay interest.*

Banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.*

War finance

But with respect to future debts; would it not be wise and just for that nation to declare in the constitution they are forming that neither the legislature, nor the nation itself can validly contract more debt, than they may pay within their own age...? ... This would put the lenders, and the borrowers also, on their guard. By reducing too the faculty of borrowing within its natural limits, it would bridle the spirit of war, to which too free a course has been procured by the inattention of money lenders to this law of nature, that succeeding generations are not responsible for the preceding.*

Wars are extremely expensive. Without finance there can be no war. War finance involves levy of taxes, raising of debts and the creation of fresh money supply, i.e. inflation. So wars are extremely lucrative for the power elite who are in control of the financial system. They use their military dominance to attack and conquer other parts of the world, take over the resources and wealth, and plunge taxpayers into more and more debt. A win-win for the power elite.

During World War I A. C. Miller wrote...

We are at war and have already taken the first steps in its financing. If all the many succeeding steps that we shall have to take in the field of finance and elsewhere are as successful as this first step in our financiering, we shall find ourselves in fortunate circumstances. Good financiering cannot win a war, but modern wars cannot be won without good finance.

During World War II Charles R. Whittlesey wrote...

The war of 1917-18 was by far the most expensive this country had ever known. Yet the cost of that war, which seemed so tremendous at the time, appears small in comparison with the cost of the present struggle. ... Both war periods are characterized by striking changes in the way banking is carried un. Some of these changes could hardly have come about under normal peacetime conditions... Because of the ability of the banking system to create the credit it provides, banks occupy a residual position with respect to government borrowing. What cannot be obtained from other sources, such as taxation and borrowing from the public, must presumably be furnished by the banks. ... The First World War marked the beginning of a period of exceptional growth and prosperity for commercial banks. ... The basic principles of Treasury policy in the present war may be summarized as follows: ... Whatever funds are needed must be provided, for finance is the servant, not the master, of wartime economic policy, and peacetime conceptions of what is sound financial policy cannot be allowed to interfere with the prosecution of the war.

In the 21st century we read...

The strength of the US economy after second world war enabled the US dollar, backed by gold, to become the world's reserve currency. When the US abandoned the gold standard in 1971, the dollar remained supreme, and its position was further boosted in 1974 when the US came to an agreement with Saudi Arabia that the oil trade would be denominated in dollars. ... With everyone clamouring for dollars, all the US had to do was print fiat dollars and other countries would accept them in payment for their exports.**

Wars and crises give the power elite the reason for creating a large amount of money from nothing. Wars mean business to the power elite in more than one way.

In fiat money we trust

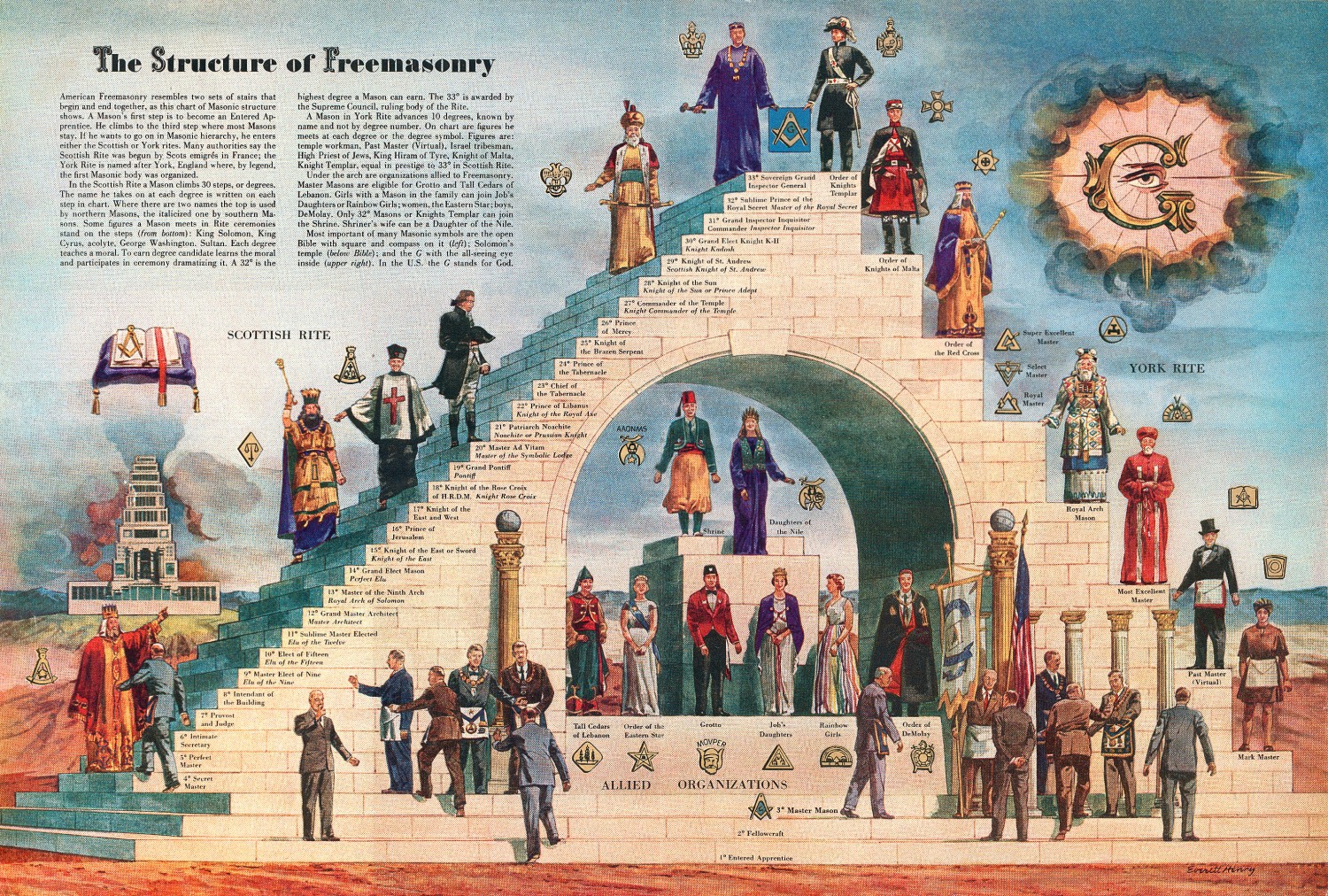

Money makes this materialistic world go round. The one dollar bill contains the words "IN GOD WE TRUST". Money is power and this is nicely symbolized by the Egyptian pyramid with the all-seeing eye of God on top. The Egyptian pyramid is a symbol of power and strong religious beliefs*. The so-called Eye of Providence symbolizes the "concept of divine providence, whereby the eye of God watches over humanity". The human power hierarchy is often depicted by a pyramid with towards the top the people with most power. Above the pyramid, with the all-seeing eye in the middle, is written "ANNUIT CŒPTIS" which can be translated as "Providence favors our undertakings". Underneath the pyramid is written "NOVUS ORDO SECLORUM" which means "New order of the ages". The all-seeing eye is also a symbol used in freemasonry. Secret orders or societies often maintain a power structure represented by a pyramid shape, the closer to the top the closer to the god imagined*. Symbols have a meaning and they are not there by accident but by design.

Interestingly, 14 presidents of the United States were Freemasons*. There's also a long list of monarchs who were freemasons*. Just goes to show that these secret societies are not to be regarded as insignificant. What is safe to say is that the pyramid symbolizes power. That it is depicted on the one dollar bill nicely coincides with the given that money is power. The all-seeing eye is a reference to the eye of god. The text "IN GOD WE TRUST" nicely coincides with the idea that money is god in this extremely materialistic world.