Federal Reserve

Federal? Reserve?

Money is power and to control money means incredible power. The Federal Reserve System, or Fed, is the central banking system of the United States. It was born out of panic and financial malaise. Its self-stated aim is to safeguard the financial system. The Fed has tremendous power economically and financially. Actions taken by the Federal Reserve influence economic conditions abroad.* Anything that happens with the US economy will affect international finances in a substantial way.* The Global Financial Crisis is an example of this.

History

The Bank of England was established in 1694 and was strongly influenced by the Rothschild banking family of England*, one of the richest families in the world. The Rothschild family is known to have established modern European banking which for some 200 years exerted great influence on the economic and the political history of Europe.* For example Alfred de Rothschild was director of the Bank of England from 1868 to 1889.

The Bank of England was seen by many American Founding Fathers as a method of oppression by the British Empire. For example Thomas Jefferson was afraid that a national bank would create a financial monopoly that might undermine state banks and adopt policies that favored financiers and merchants, who tended to be creditors, over plantation owners and family farmers, who tended to be debtors. Of course that's the correct view because the power of banks and their ultra-rich owners skyrocketed while the nations and the people are living in a world of debt. Other influential Founding Fathers wanted to create a central bank like the Bank of England.

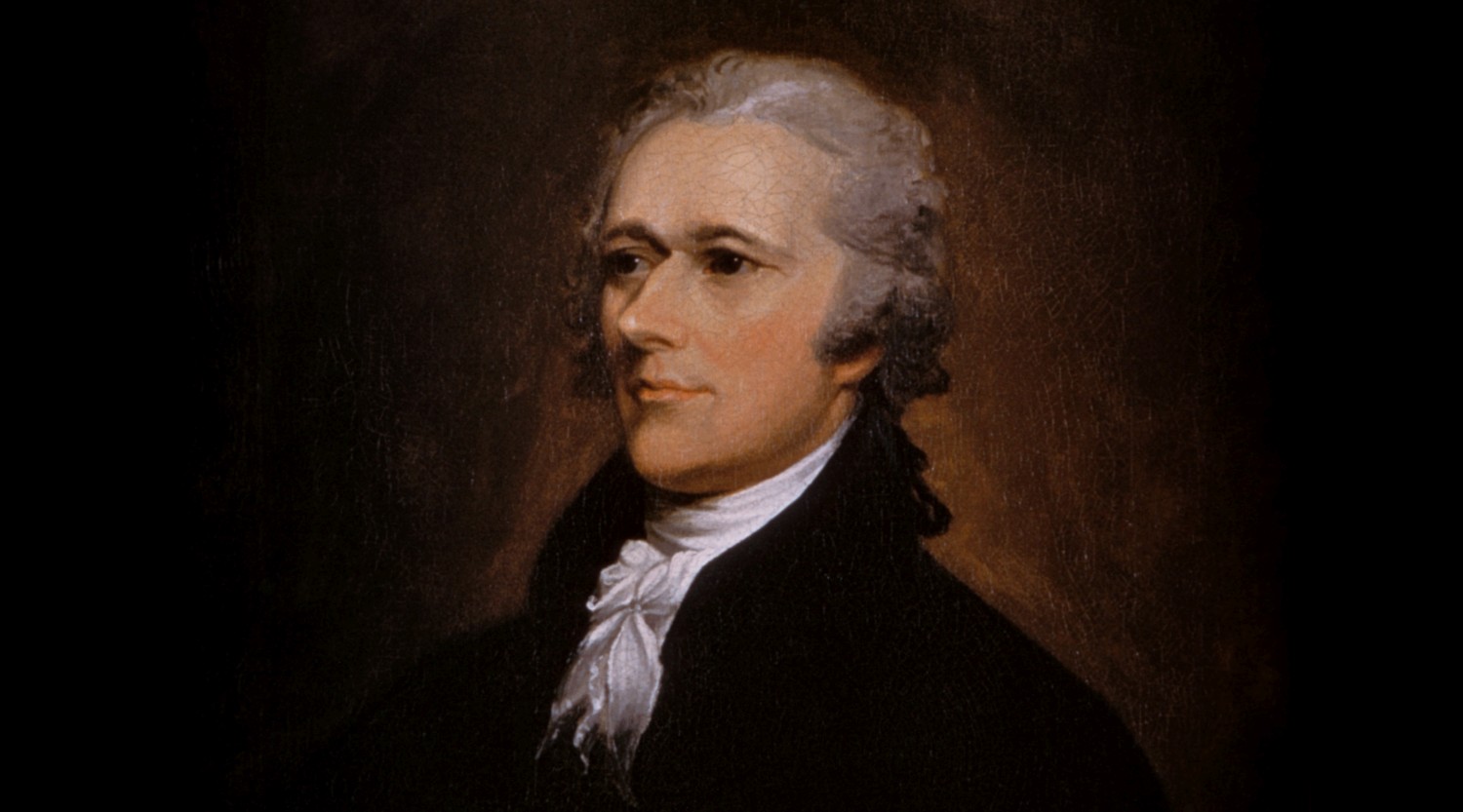

Alexander Hamilton succeeded in convincing Congress into establishing the First Bank of the United States in 1791. The powerful Hamilton family is closely linked to for example the powerful Morgan banking family and to the du Pont industrial family. Historically ultra-rich families are linked because of the tradition to keep their wealth and power in their families. Éleuthère Irénée du Pont later became director of the Second Bank of the United States of which ultra-rich Stephen Girard became large stockholder and director. Birds of a feather flock together.

All powerful positions, including that of US Presidents, were occupied by "friends" linked to one or more ultra-rich families. The Hamilton family is for example also linked to the ultra-rich Livingstone family which produced the Bush dynasty, including two US presidents. It is also linked to the influential Schuyler family which is linked to the Roosevelt family which provided two US presidents. Etcetera.

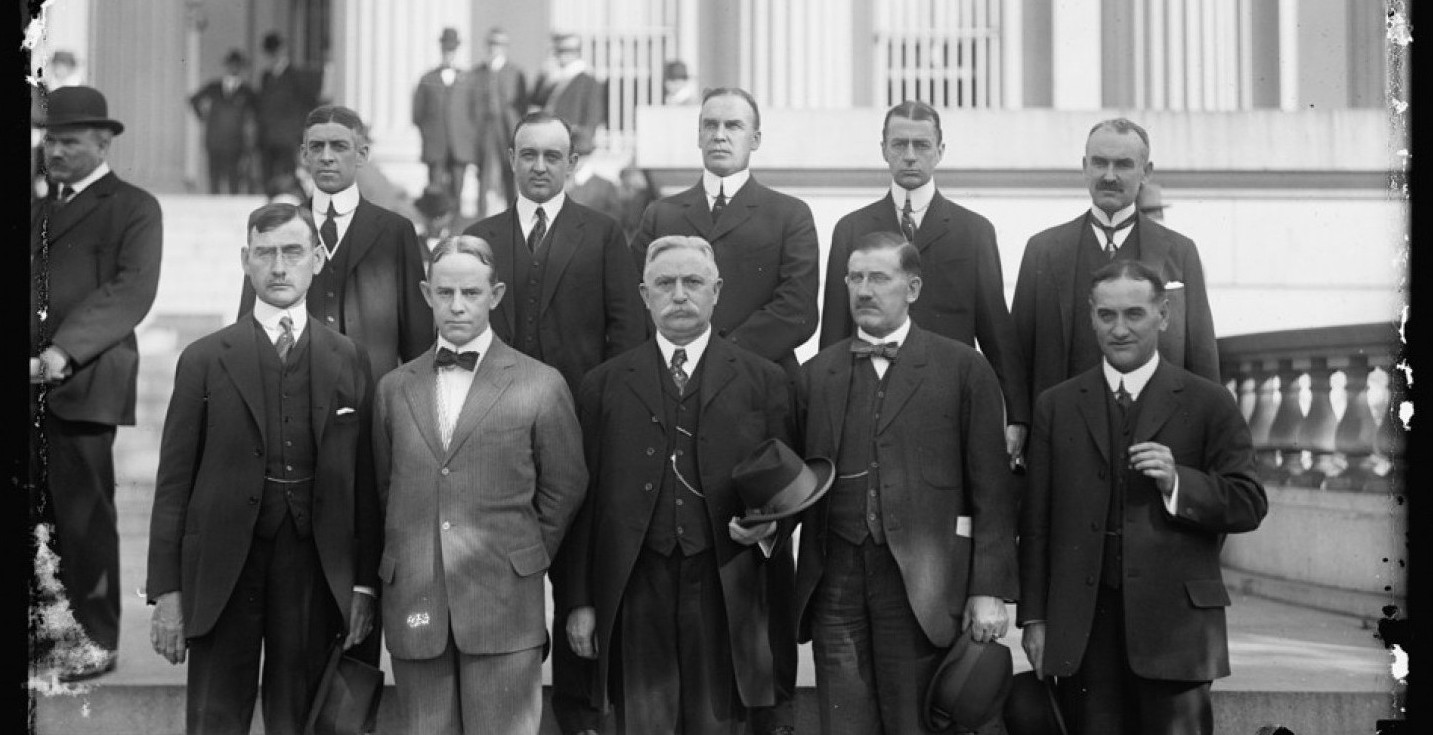

In 1910 a highly secretive meeting was held at Jekyll Island* by Nelson W. Aldrich, A. Piatt Andrew, Henry Pomeroy Davison (J.P. Morgan & Co.), Arthur Shelton, Frank Vanderlip (president of the National City Bank of New York, associated with the Rockefellers) and Paul Warburg (of the ultra-rich Warburg family) where the Federal Reserve System was born in secret. Aldrich had close ties with J.P. Morgan and other important bankers, and his eldest daughter, Abigail Greene Aldrich, was married to John D. Rockefeller Jr., one of the richest and most influential people, whose Standard Oil was found guilty in 1912 of monopolizing the petroleum industry through a series of abusive and anticompetitive actions.* Extreme inequality shows that most of the money created by central banks ended up in the bank accounts of these self-styled "philanthropists" while the rest suffered the consequences. World War I and II were not possible if it weren't for these central banks.

The timing of the creation of the Federal Reserve System under president Woodrow Wilson, on 23 December 1913, was such that a lot of Congress members were having Christmas holidays. Wilson was indoctrinated by Bernard Baruch known for amassing a fortune on the NY Stock Exchange and managing the US's economic mobilization in World War I as chairman of the War Industries Board, in close partnership with the infamous and lucrative military industry. Bernard Baruch was a close friend of Maurice de Rothschild with whom he for example went on a sail trip in 1934* together with Maurice Wertheim, New York banker and director of The Nation.

World War I started only half year after the Fed was created. It was labeled Wilson's "war to end all wars" and it transformed the Federal Reserve into a true central bank by increasing its financial resources and transforming the US dollar into a major international currency.* The British Empire transformed into the Anglo-American Empire and the "war to end all wars" led to a century of aggressive wars to further expand the power of the Anglo-American elite.

Federal?

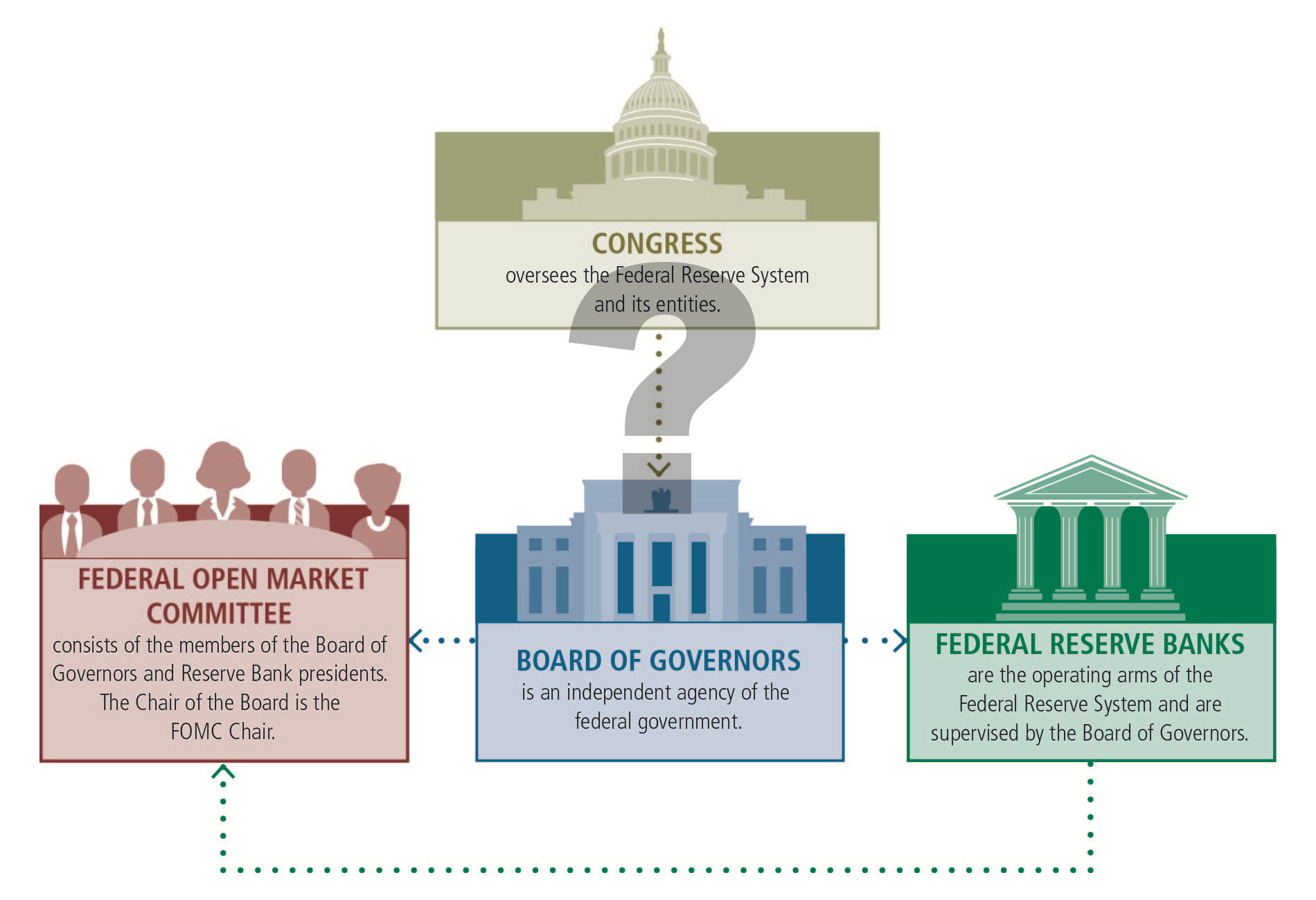

There are three key entities in the Federal Reserve System: the Board of Governors, the Federal Reserve Banks (Reserve Banks), and the Federal Open Market Committee (FOMC). The Board of Governors, an agency of the federal government that reports to and is directly accountable to Congress, provides general guidance for the System and oversees the 12 Reserve Banks.*

The Fed says its Board of Governersis directly accountable to the Congress* andthe Federal Reserve is subject to oversight by Congress* But how "accountable" is it and how is "oversight" defined?

Effective congressional oversight is complicated by the complex, technical nature of monetary policymaking. There is no group with monetary policy expertise tasked by Congress with evaluating the Fed's actions. The conduct of monetary policy is outside the review of the Government Accountability Office (GAO).* The Fed states...

Though the Congress sets the goals for monetary policy, decisions of the Board--and the Fed's monetary policy-setting body, the Federal Open Market Committe--about how to reach those goals do not require approval by the President or anyone else in the executive or legislative branches of government.*

There is no monetary policy oversight by Congress, neither is there any approval of government needed for it. The Federal Reserve Transparency Act of 2015 would have opened up the Federal Reserve System to a more complete audit, but was rejected by a vote of 53–44, with most Republicans voting in favor and most Democrats voting against.* The Fed and its owners don't like transparency. William Greider's book Secrets of the Temple: How the Federal Reserve Runs the Country states that the Fed is in some ways more secretive than the CIA and more powerful than the President or Congress. Secrecy is the opposite of transparency and everybody knows how secrecy and corruption go hand in hand and that secrecy and democracy are contrary to each other.

The name "Federal" Reserve is misleading the public into believing that the Fed is owned and controlled by the government when in fact the government has no real power over it, merely limited "oversight", and if needed the political elite will vote in favor of the FED. If at all the government would want to make use of a statute to change the Fed it can and will be blocked by the Fed and the power elite in control of it.

Who really owns it?

The Fed says about itself...

Some observers mistakenly consider the Federal Reserve to be a private entity because the Reserve Banks are organized similarly to private corporations. ... Commercial banks that are members of the Federal Reserve System hold stock in their District's Reserve Bank. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System.*

Unlike private corporations, Reserve Banks are not operated in the interest of shareholders, but rather in the public interest.

But is this true?

The Fed in San Francisco states:Is the Federal Reserve a privately owned corporation? Yes and no.* In 1977 David Friedman wrote that the 12 regional reserve banks aren't government institutions, but corporations nominally 'owned' by member commercial banks.* The Reserve Bank is owned by its shareholders. Those shareholders are commercial banks. Commercial banks are operated for profit. Eventhough the Fed is owned by shareholders who operate for profit, the Federal Reserve itself claims not to be operated for profit. Why would any for-profit bank want to be shareholder of any entity unless there is in some way some kind of profit involved?

Some people think the Federal Reserve banks are United States Government institutions. They are not Government institutions. They are private credit monopolies which prey upon the people of the United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders.*

Our money system is not what we have been led to believe. The creation of money has been privatized, or taken over by a private money cartel. Except for coins, all of our money is now created as loans advanced by private banking institutions -- including the Federal Reserve.

The name sounded "public" and "of the government," and indeed the act delineated the Fed's ability to balance credit, monitor inflation, and help cultivate employment. ... And yet its members were the private banks that wanted it to exist.The Board of Governers would be selected by the president, and the Board of the New York Fed would be closest to the Wall Street bankers, who would hold most of the sway over the Federal Reserve System because they controlled the largest portion of reserves.

It would be naive to believe that central banks are not privately owned. Ultimately even the governments are privately owned because the political elite first of all serve the power elite higher in the hierarchy of power. President Woodrow Wilson signed the Federal Reserve Act into law and he was in close contact with the people who wanted it. Wilson had close contact with Otto Hermann Kahn*, a powerful banker of Kuhn, Loeb & Co.* with much influence on politics. Another extremely powerful banker, Paul Warburg, was instrumental in the creation of the Fed*. Warburg supported Wilson in his presidential campaign.* Warburg was chosen by Wilson to serve as one of the first members of the Federal Reserve Board.* The Warburg family always had a close relationship with the Rothschild family*, perhaps the richest and most powerful family on earth. Birds of a feather flock together.

With for example the global financial crisis governments used taxpayer money to bail out corrupt and bankrupt banks under the guise of lies like "too big to fail". There are plenty tax havens around the world because the governments allow them to exist. Central banks print fiat money from nothing and lend it to governments who lend it to corporations. That money then has to be repaid with interest by taxpayers in the future. Debt is an instrument of power by which complete nations and countries are controlled. See also World Bank & IMF.

The hidden money supply

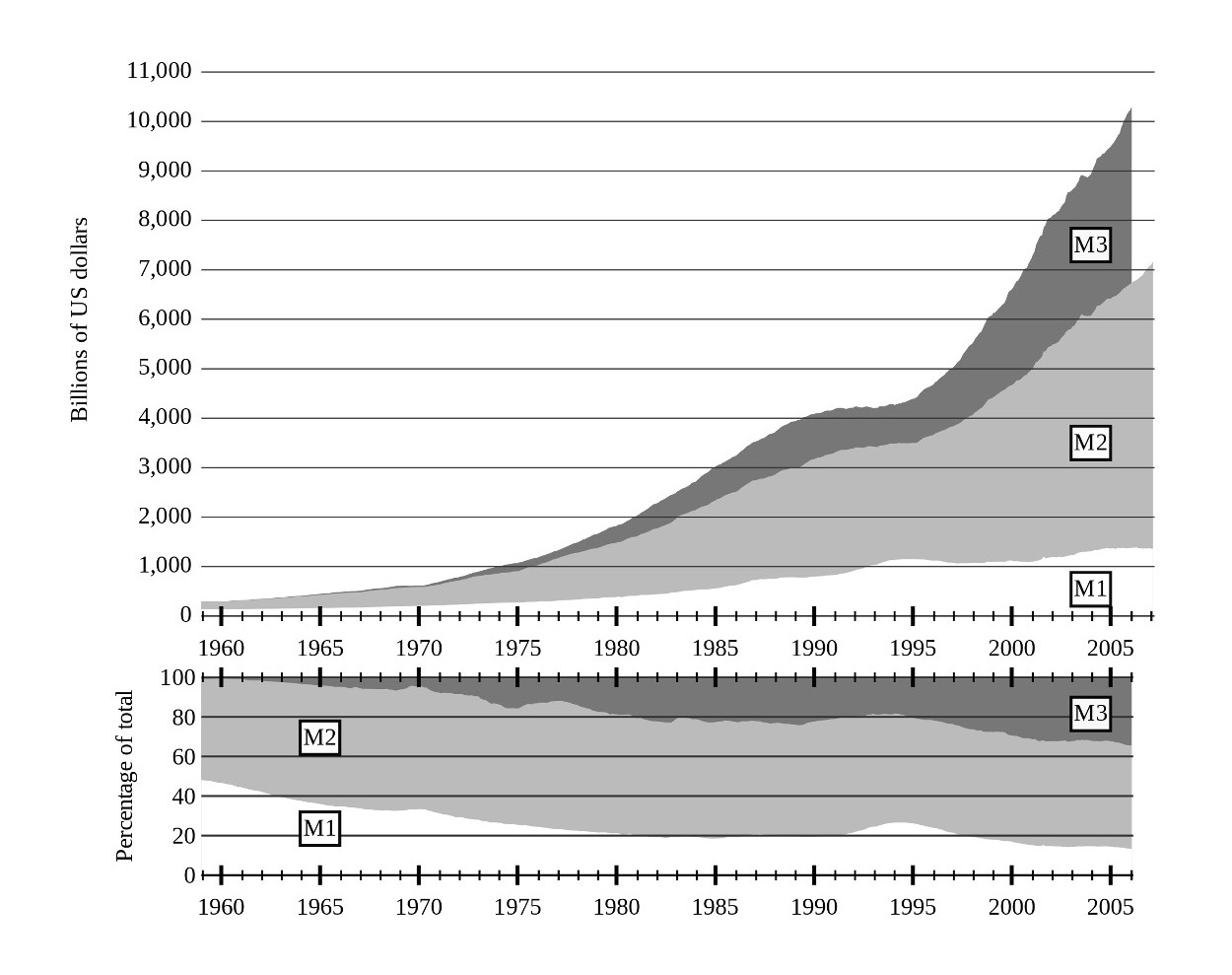

Commercial bank money that tends to exist in larger amounts are categorized in M2 and M3. On March 9, 2006, the Fed announced it would cease publication of the M3 monetary aggregate*

John Williams of Shadowstats noted the oddity of the announcement, opining that M3 was probably the most important statistic produced by the Fed and the best leading indicator of economic activity and inflation. The Fed's lack of interest in the components of M3 can be directly linked to its inability to foresee the 2008 collapse of the financial system.*

In 2006 The Fed stopped publishing the value of M3 which makes up the largest quantity of the money supply. This happened just before the global financial crisis struck the world. Inflation is closely related to the money supply which is under the control and supervision of the central banks. Inflation is also called a "hidden tax"*.

Who benefits?

Antony C. Sutton wrote The Federal Reserve Conspiracy in which he exposed the people and forces behind the takeover of the US economy by the Federal Reserve system, on behalf of the oligarchs.

G. Edward Griffin wrote The Creature from Jekyll Island : A Second Look at the Federal Reserve about how the richest and most powerful bankers in the world, along with a U.S. Senator, wrote the proposal to launch the Federal Reserve System to control the financial system so that the bankers will always come out on top.

The one thing the Fed failed to accomplish above all else was what it was established to do in the first place. But it's much worse than that if we understand a cartel's real motives. It's not to serve the public interest. It's to abuse it because that's how it benefits most. It's able to do it with its legally sanctioned concentrated power and a friendly government in league with it as partners or facilitators. It's from that cozy hidden from view arrangement that it's able to get away with the grandest of grand thefts.*

Economic inequality spiraled completely out of control in the last decades. The global financial crisis revealed much about the banking system and the power of central banks. Whenever the central banks pump money into the system the people who get the money first can use the money when the increase in money supply has not yet caused increase in prices. This is called the Cantillon Effect. This also shows the scam of so-called trickle-down economics so often promoted by the power elite who of course benefit from it themselves. Most of the money never reaches the common taxpayers who in the end are forced to pay back all the loaned money with interest while the prices of goods increase more than their salaries.*

For young people in high-opportunity metro areas, the route to home ownership is basically blocked without the help of a wealthy family member or some stock options.* From 2000 to 2019 in California, one of the states where most of the money is made in the US, salaries increased from 46,816 to 78,105 while the house price index increased from 261% to 654% (compared to 100% for 1980). The increase in house prices is not only due to shortage or supply problems, but mainly due to the increase of money pumped into the system driving up prices.* Since the COVID-19 crisis in 2020 52% of young adults resided with one or both of their parents, up from 47% in February*, while the wealth of billionaires increased significantly.*