Global Financial Crisis

Cui bono?

source

We are in the midst of the worst financial crisis since the Great Depression. This crisis is the latest phase of the evolution of financial markets under the radical financial deregulation process that began in the late 1970s. This evolution has taken the form of cycles in which deregulation accompanied by rapid financial innovation stimulates powerful financial booms that end in crises. Governments respond to crises with bailouts that allow new expansions to begin. As a result, financial markets have become ever larger and financial crises have become more threatening to society, which forces governments to enact ever larger bailouts. This process culminated in the current global financial crisis, which is so deeply rooted that even unprecedented interventions by affected governments have, thus far, failed to contain it.

The financial crisis of 2007 and 2008 is considered by many economists the worst financial crisis since the Great Depression of the 1930s. The financial crisis was the result of systemic corruption. Due to the crisis incredible amounts of fiat money were created from nothing in order to "save" the economy.

Most people think that the big bank bailout was the $700 billion that the treasury department used to save the banks during the financial crash in September of 2008. But this is a long way from the truth because the bailout is still ongoing. The Special Inspector General for TARP summary of the bailout says that the total commitment of government is $16.8 trillion dollars with the $4.6 trillion already paid out. Yes, it was trillions not billions and the banks are now larger and still too big to fail. But it isn't just the government bailout money that tells the story of the bailout. This is a story about lies, cheating, and a multi-faceted corruption which was often criminal.*

Governments respond to crises with bailouts that allow new expansions to begin. Those bailouts are largely paid for with borrowed money from central banks which print massive amounts of fiat money. That borrowed money will then have to be paid back by future generations which are indebted more and more. With time financial crises become more and more frequent and severe. A paper from 1998 mentioned:Over the last two decades financial crises have tended to occur increasingly frequent. ... Since most such weaknesses are structural (unemployment, high debt, weak financial and banking systems), the problem cannot be corrected in the short run, during the crisis.Due to globalization and interdependency crises affect larger parts of the world and more people.

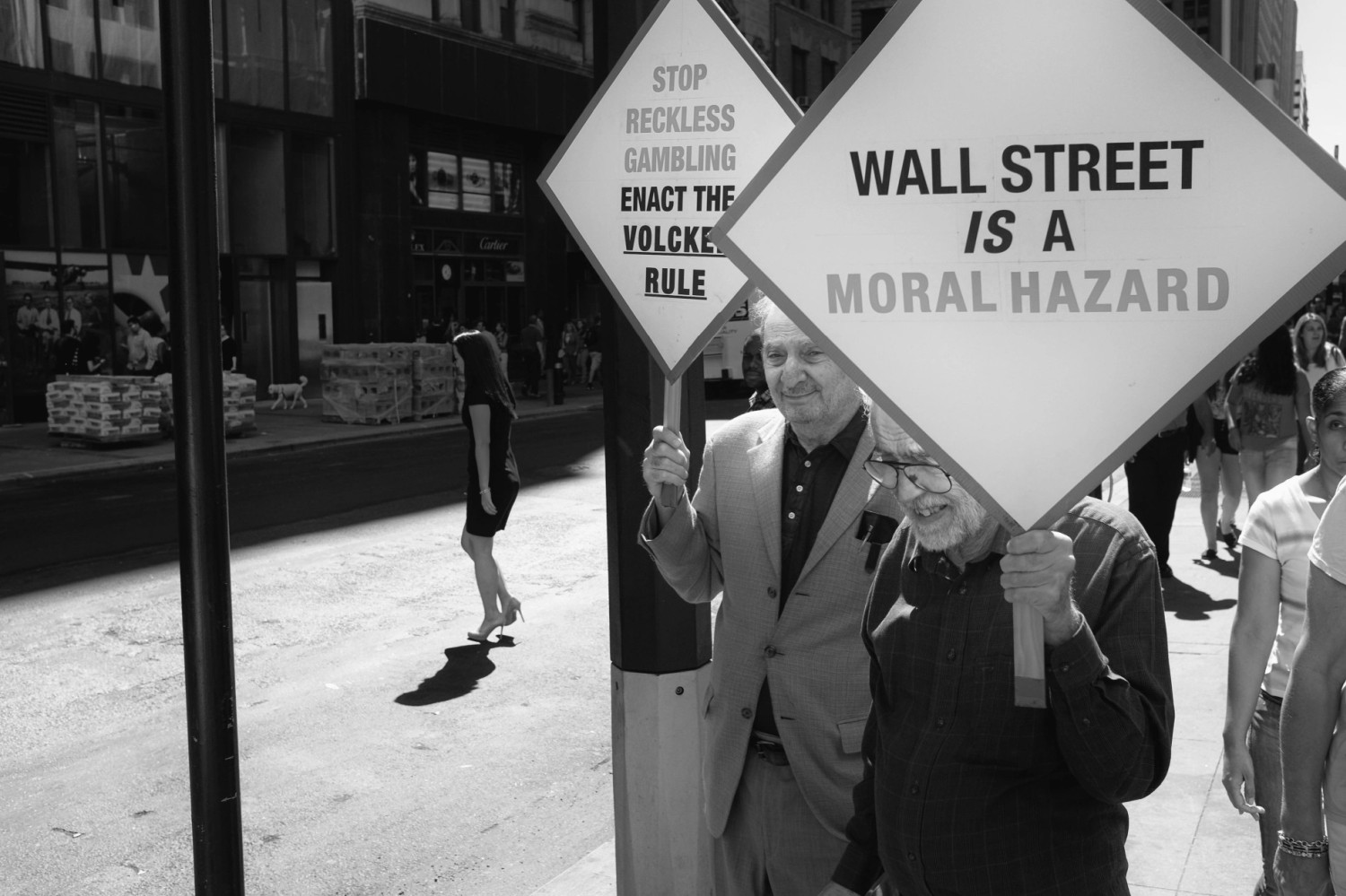

Moral hazard as a result of implicit or explicit government guarantees encouraged overborrowing and excessive exposure to foreign exchange by financial institutions (...). The essence of moral hazard is that, if things went wrong, agents "rationally expect the government to step in and modify its course of action in order to bail out troubled private firms"

When governments guarantee the survival of commercial banks then the financial elite in control of those banks will more likely take financial risks. The financial elite expected governments to bail them out in case they would go bankrupt.

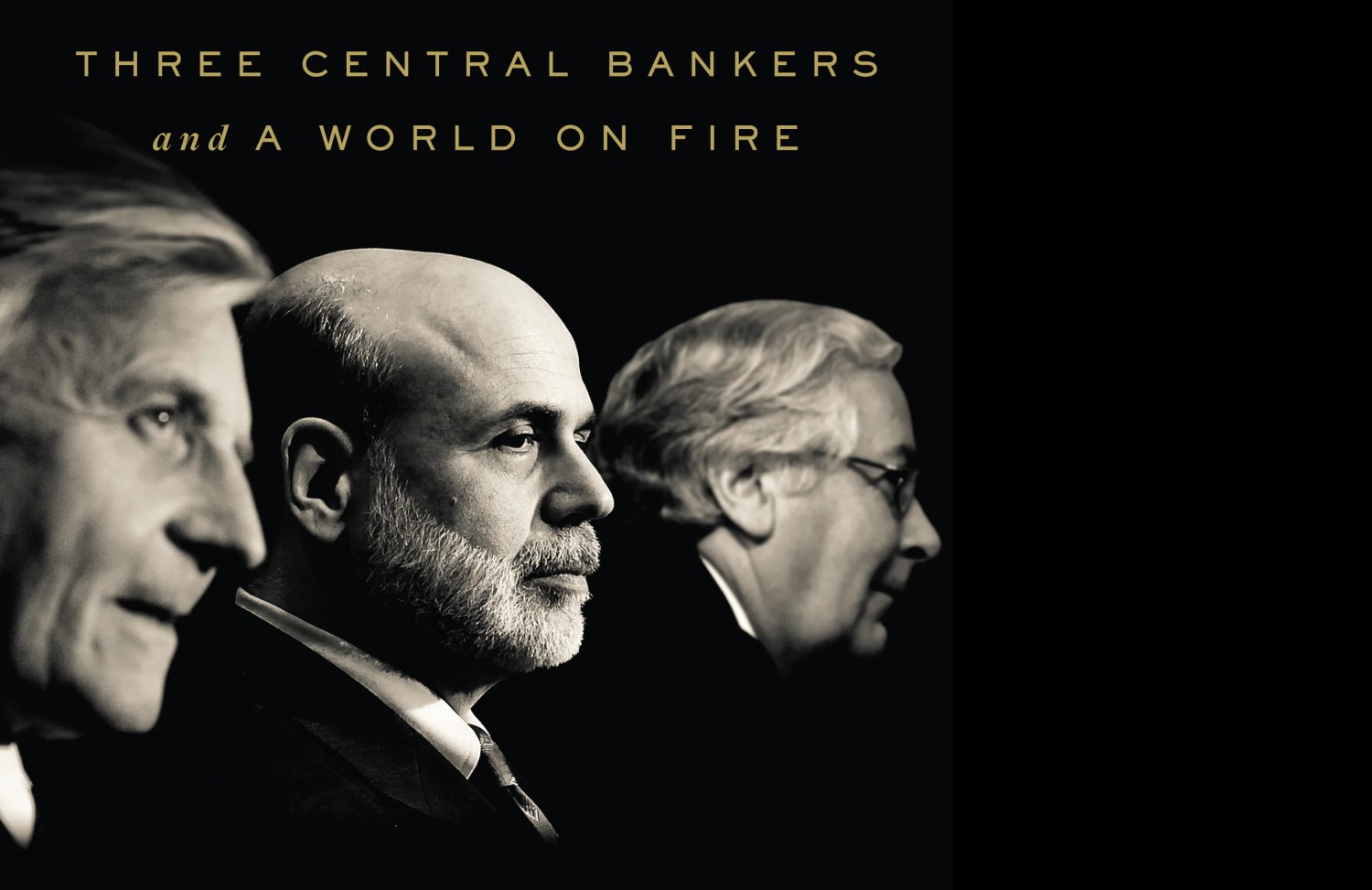

It is clear the crisis had multiple causes. The most obvious is the financiers themselves—especially the irrationally exuberant Anglo-Saxon sort, who claimed to have found a way to banish risk when in fact they had simply lost track of it. Central bankers and other regulators also bear blame, for it was they who tolerated this folly.

The main underlying cause of these financial crises has a lot to do with systemic corruption. Terms related to this financial crisis are moral hazard, adverse selection, deregulation, bait-and-switch methods, falsification of mortgage documents, shadow banking, subprime lending, etcetera.

Too big to jail

Financial crooks brought down the world's economy — but the feds are doing more to protect them than to prosecute them.

It is now almost five years since the world's financial system was brought to its knees and had to be bailed out by taxpayers at a cost of billions. Millions of people lost their jobs or suffered from lower living standards because of the recession brought on by the financial collapse. Yet almost no bankers have faced legal sanctions for their part in precipitating the crisis.*

Elizabeth Warren criticized the failure of both federal regulators and Justice Department officials to prosecute or otherwise hold to account Wall Street banks and financial institutions despite their long and steady pattern of blatantly criminal activity.*

Ben Bernanke was the frontman of the FED who pushed for bailout. In regard to the 700 billion bail out plan he said to the Congressional leaders:If we don’t do this, we may not have an economy on Monday.* The power elite use fear as a political tool in order to sell government bailouts to the taxpayers as part of their too big to fail scam.

The claims of the Federal Reserve, FDIC and Treasury regarding the bad things that would happen if the large institutions were allowed to fail were wildly overstated. In my book, I went through the available documentation at the time and there never was any clear underlying evidence presented of what is called contagion or the domino effect, which means if you let one fail they all start to topple. It was all just wild speculation about what might happen to justify extending the bailouts.*

The financial crisis happened because banks were able to create too much money, too quickly, and used it to push up house prices and speculate on financial markets.*

A decade has passed since investment bank Lehman Brothers collapsed and the economy spiraled into the Great Recession and a foreclosure maelstrom. Even today, some Americans are still struggling to regain their footing. The worst financial disaster since the Great Depression, the financial crisis wiped out almost $8 trillion in household stock market wealth and $6 trillion in home value. As many as 10 million Americans are believed to have lost their homes, according to the St. Louis Federal Reserve. Ten years on, many Americans still bear the scars of the crisis.*